Retirement Home Money

Wealth is a person’s ability to survive so many number of days forward—or, if I stopped working today, how long could I survive? (Location 1098)

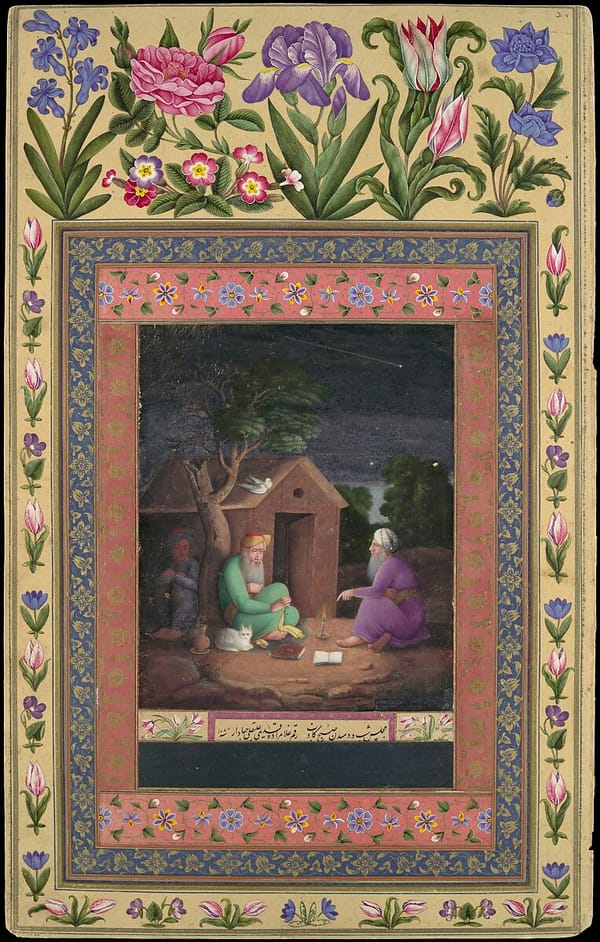

Money should age like a fine wine. The grain silo of old money is a anxiety cleanser.

When I say mind your own business, I mean to build and keep your asset column strong. Once a dollar goes into it, never let it come out. Think of it this way: Once a dollar goes into your asset column, it becomes your employee. The best thing about money is that it works 24 hours a day and can work for generations. Keep your day job, be a great hardworking employee, but keep building that asset column. As your cash flow grows, you can indulge in some luxuries. An important distinction is that rich people buy luxuries last, while the poor and middle class tend to buy luxuries first. The poor and the middle class often buy luxury items like big houses, diamonds, furs, jewelry, or boats because they want to look rich. They look rich, but in reality they just get deeper in debt on credit. The old-money people, the long-term rich, build their asset column first. Then the income generated from the asset column buys their luxuries. (Location 1229)

Money is best spent in a way where it has the opportunity to replicate itself or grow like a garden. Not all activities need to be income generating activities, but there should be a strong preference for when time and money are both involved to spend on a potential future asset. Lowering expenses also lets money grow. Let's make everyone old-rich, in one lifetime!